Understanding Risk and Rewards with Direct Hard Money Lenders

Wiki Article

Just How Hard Cash Loans Can Increase Your Building Investment Trip

Hard money Loans offer a distinct possibility for home capitalists looking for fast access to funding. Unlike standard financing, these Loans concentrate on the value of the home instead of the consumer's credit scores background. This technique allows investors to act swiftly in open markets or profit from distressed residential or commercial properties. Comprehending the complexities of Hard money Loans is necessary for optimizing their benefits and decreasing potential mistakes. What elements should investors consider before continuing?

Recognizing Hard Cash Lendings: An Overview

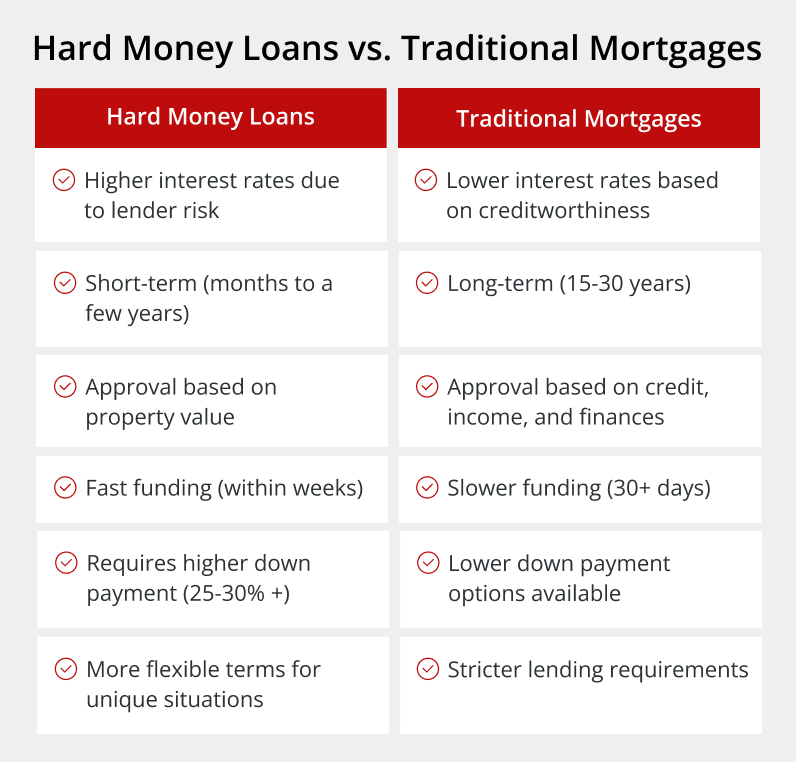

Usually considered a last resort, Hard cash Loans offer as a feasible financing option for building capitalists looking for rapid access to capital. These Loans are usually provided by private loan providers and are protected by real estate as opposed to the consumer's creditworthiness. Because they count on the home's value, authorization procedures are quicker than conventional financing methods. Hard cash Loans typically include greater rates of interest and much shorter payment terms, mirroring the enhanced threat to lending institutions. When they require financing in a competitive market, financiers typically make use of these Loans for fix-and-flip tasks or. Comprehending the structure and function of Hard cash Loans is important for investors intending to take advantage of this financing approach effectively in their building financial investment strategies.The Advantages of Hard Money Loans for Capitalists

One significant advantage of Hard money Loans for financiers is the rate at which they can protect financing. Unlike typical funding, which frequently includes extensive authorization processes, Hard cash Loans can be accessed rapidly, permitting financiers to seize rewarding possibilities as they emerge. Furthermore, Hard cash lending institutions often think about the value of the home as opposed to the consumer's credit reliability, making it much easier for those with less-than-perfect credit scores to get funding. This versatility can be particularly helpful genuine estate financiers looking to profit from affordable markets or troubled residential or commercial properties. Hard cash Loans can offer bigger sums of funding, making it possible for investors to carry out considerable renovations or procurements that can lead to higher returns on investment.The Application Refine: What to Anticipate

What can investors expect when maneuvering the application process for Hard cash financings? Originally, they will certainly require to prepare essential paperwork, consisting of property information, financial statements, and a clear financial investment approach. Unlike standard fundings, the procedure is typically much faster, often finished within days. Capitalists can anticipate a comprehensive evaluation of the residential or commercial property's value instead of their individual credit report, as Hard money lenders concentrate on the property's possibility. Additionally, consumers ought to be prepared for discussions pertaining to financing terms, including interest rates and repayment timetables. Openness is crucial, so investors ought to ask concerns to assure they comprehend all elements of the contract. On the whole, the process is simple, enabling capitalists to seize possibilities promptly.Just how to Select the Right Hard Cash Lending Institution

How can financiers guarantee they select the most ideal Hard cash lender for their demands? They ought to assess the loan provider's experience and credibility within the market. Investigating online evaluations and looking for suggestions from fellow investors can give useful understandings. Next off, reviewing the terms of the funding, consisting of rates of interest, costs, and payment routines, is essential to confirm positioning with investment objectives. In addition, capitalists need to inquire concerning the loan provider's financing speed and versatility, which can greatly affect their capacity to take possibilities. Finally, clear interaction is necessary; a lender who is ready and responsive to describe complicated terms can foster a more efficient collaboration. By concentrating on these aspects, financiers can make enlightened choices when choosing a difficult cash loan provider.Utilizing Hard Cash Loans for Home Renovation and Flipping

While conventional funding choices usually drop short for quick-turnaround tasks, Hard money Loans present an appealing option for building financiers concentrated on renovation and turning. Direct Hard Money Lenders. These Loans are commonly safeguarded by the residential property itself, allowing for faster accessibility to funds without the extensive approval procedures common in standard loaning. Capitalists can take advantage of Hard money Loans to get troubled residential properties, enabling them to implement improvements that enhance market price quickly. The adaptability of these Loans commonly enables for a range of project extents, from minor updates to major overhauls. Because of this, Hard cash Loans empower capitalists to utilize on market opportunities, turning residential properties right into Your Domain Name rewarding financial investments within a pressed timeline, eventually raising their return on financial investment

Considerations and threats When Using Hard Money Loans

High Passion Prices

Hard money Loans can offer quick access to funding for building financial investment, they typically come with significantly high interest rates that can posture considerable financial threats. These elevated rates, commonly ranging from 8% to 15%, can significantly enhance the general expense of loaning. Investors may locate themselves paying a lot more in passion than they anticipated, which can eat into potential earnings. Furthermore, the high rates may pressure consumers to produce fast returns, bring about hasty financial investment decisions. If residential property values do dislike as expected or if rental revenue fails, capitalists might deal with financial stress. Consequently, cautious consideration of the total rate of interest costs and the project's feasibility is important before waging a difficult money car loan.

Brief Loan Terms

Brief financing terms connected with Hard money Loans can pose substantial obstacles for capitalists. Usually varying from a few months to 3 years, these short periods require debtors to implement their financial investment strategies swiftly. The stress to promptly remodel or offer a residential or commercial property can bring about hasty decisions, potentially resulting in financial losses. In addition, the looming due date might restrict the capitalist's ability to secure beneficial resale or refinancing choices (Direct Hard Money Lenders). The fast-paced nature of these Loans can also increase tension, affecting the financier's judgment. Careful planning and a well-defined leave method are important to see this website alleviate risks connected with brief finance terms. Investors have to weigh the potential benefits against the necessity these Loans impose on their investment timelinesSecurity Risks

Collateral risks represent a crucial factor to consider for investors making use of Hard money fundings. When protecting a funding, the residential or commercial property itself frequently works as security, meaning that failing to pay off the finance can result in the loss of look at these guys the possession. This risk is especially obvious in volatile actual estate markets, where residential or commercial property worths can rise and fall substantially. Investors need to additionally think about the potential prices associated with foreclosure, which can include extra costs and legal charges. Additionally, the reliance on collateral might lead to hasty investment choices, as consumers might focus on safeguarding financing over thorough market evaluation. Because of this, understanding security dangers is vital for capitalists to make informed decisions and protect their economic interests in building investments.

Frequently Asked Inquiries

What Sorts Of Characteristic Get Approved For Hard Money Loans?

Various building kinds receive Hard money lendings, including residential homes, industrial buildings, fix-and-flip residential properties, and land. Lenders commonly examine the residential or commercial property's value and potential as opposed to the borrower's credit reliability for approval.How Do Rate Of Interest on Hard Money Loans Compare to Conventional Loans?

Rates of interest on Hard cash Loans normally exceed those of standard financings, mirroring their temporary nature and greater risk. Investors typically accept these rates for quicker accessibility to capital, despite the increased economic concern.Can I Use Hard Cash Loans for Business Features?

Hard money Loans can be made use of for business residential properties, supplying financiers with quick accessibility to funding. These Loans are usually secured by the residential property's value, permitting flexibility in financing numerous business realty ventures.Are Hard Cash Loans Available for First-Time Investors?

Hard cash Loans are certainly obtainable to novice investors, providing a sensible funding choice regardless of higher rate of interest rates. Lenders usually evaluate the residential or commercial property's value greater than the borrower's credit history, making these Loans appealing for novices.

What Happens if I Default on a Hard Money Loan?

The lending institution may launch foreclosure process if a specific defaults on a tough cash funding. This might lead to the loss of the property and damage to the borrower's credit, influencing future loaning possibilities.Often taken into consideration a last hotel, Hard cash Loans serve as a practical financing alternative for property capitalists seeking quick access to capital. While traditional financing alternatives often fall brief for quick-turnaround jobs, Hard cash Loans provide an appealing service for building financiers concentrated on restoration and flipping. Brief finance terms associated with Hard cash Loans can pose substantial difficulties for investors. When safeguarding a financing, the building itself usually offers as collateral, suggesting that failure to settle the car loan can result in the loss of the asset. Rate of interest rates on Hard money Loans usually exceed those of traditional lendings, mirroring their temporary nature and higher danger.

Report this wiki page